HomePro USA

The Premier Resource For All Real Estate Information & Services In North Carolina

Contact UsSearch For Homes

Learn More Today!

Who We Are

Welcome to the premier resource for all real estate information and services in the area. We hope you enjoy your visit and explore everything our realty website has to offer, including Fayetteville real estate listings, information for homebuyers and sellers, and more About Us, your professional Fayetteville Realtors. Looking for a new home? Use Quick Search or Map Search to browse an up-to-date database list of all available properties in the area, or use our Dream Home Finder form and we will conduct a personalized search for you. If you're planning to sell your home in the next few months, nothing is more important than knowing a fair asking price. We would love to help you with a FREE Market Analysis. We will use comparable sold listings to help you determine the accurate market value of your home.

About Jack

Our Listings

Real Estate News

Facts: The average 30-year fixed mortgage rate from Freddie Mac remained unchanged at 6.35% this week from last week. At 6.35%, with 20% down, a monthly mortgage payment on a home with a price of $400,000 is $1,991. With 10% down, the typical payment would be $2,240. Read more about Jessica Lautz's take here: https://www.nar.realtor/blogs/economists-outlook/instant-reaction-mortgage-rates-september-5-2024

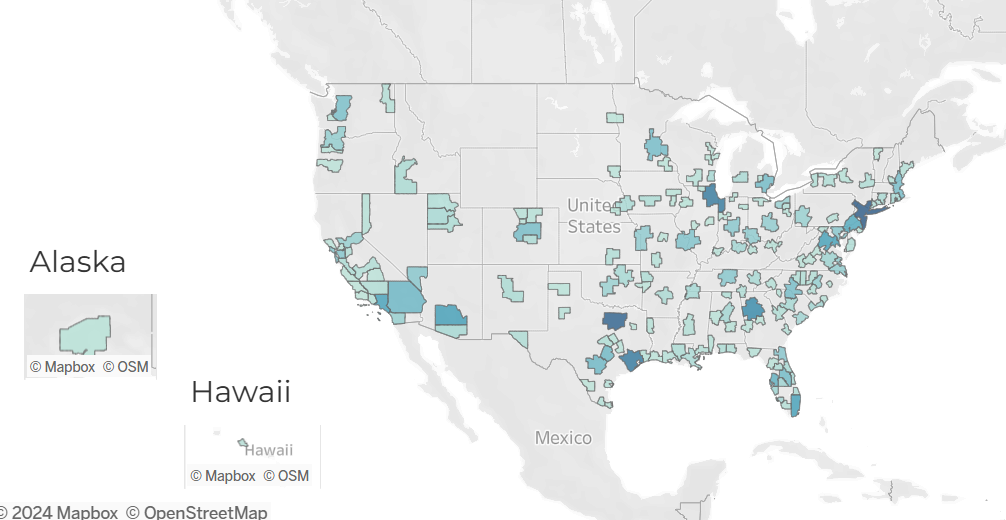

The Home Mortgage Disclosure Act (HMDA) provides detailed information on mortgage lending activity, offering valuable insight into housing demand. Data on the number of loan applications can indicate whether housing demand is strong or weak, while approval rates reflect individuals' and families' ability to secure financing. Additional information, such as interest rates, income distribution, and property values, can paint a picture of the local economy. Read more about Anat Nusinovich's take here: https://www.nar.realtor/blogs/economists-outlook/hmda-and-housing-demand

The net monthly job addition averaged 116,000 from 3 months to August. That is light. It even suggests the possibility of turning net negative in the upcoming months if the economy hits an unexpected speed bump. The softening job figures suggest that the Federal Reserve will cut interest rates in mid-September, again on the day after the election, and possibly four more times in 2025. The long-term bond and mortgage markets have already incorporated these upcoming changes. That is why the average mortgage rate is 6.3%, measurably lower than the 7% to 8% seen in the past 18 months. Mortgages with full government guarantees, like FHA and VA loans, are already below 6%. Read more about Lawrence Yun's take here: https://www.nar.realtor/blogs/economists-outlook/instant-reaction-jobs-september-6-2024